An ITIN is a nine-digit number issued by the IRS to individuals who are required for federal tax purposes to have a U.S. taxpayer identification number but who don’t have and aren’t eligible to get a social security number (SSN).

The ITIN is for federal tax purposes only. An ITIN doesn’t entitle you to social security benefits and doesn’t change your immigration status or your right to work in the United States. Also, individuals filing tax returns using an ITIN aren’t eligible for the earned income credit (EIC).

Any individual who isn’t eligible to get an SSN but who must furnish a taxpayer identification number for U.S. tax purposes or to file a U.S. federal tax return must apply for an ITIN on Form W-7.

So how do I get one?

The most common reason to request an ITIN is the need to file your Federal income taxes, so you will need to have your taxes prepared (making sure the field for the SS Number is left blank in the Form 1040), and then submit your taxes along with Form W-7 and also originals of the accepted identifying documents. Follow the links below to the IRS website where you can download the Form W-7 and the Instructions to Form W-7.

How do I renew it?

The process for renewing your ITIN is very similar to when you request it for the first time. You need to CORRECTLY fill out the W-7 form fields and make sure to select the correct options according to the Form W-7 instructions. The major difference is that you don’t have to send the Form W-7 along with a tax return. You only send the Form W-7 and the original identifying documents to the IRS. Keep reading for information on how you can avoid having to send your original documents.

Can I fill out the Form W-7 myself?

Yes, you can fill out the form yourself and submit to the IRS address shown in the instructions. However, as you may have already heard or experience it yourself, dealing with the IRS is not easy and if you don’t know how to CORRECTLY fill out this form, it most likely will be rejected and send back to you for corrections. One of the major downside to this happening is the big delay that this will create. Also, having to send your original documents to the IRS expose them to the risk of getting lost in the mail.

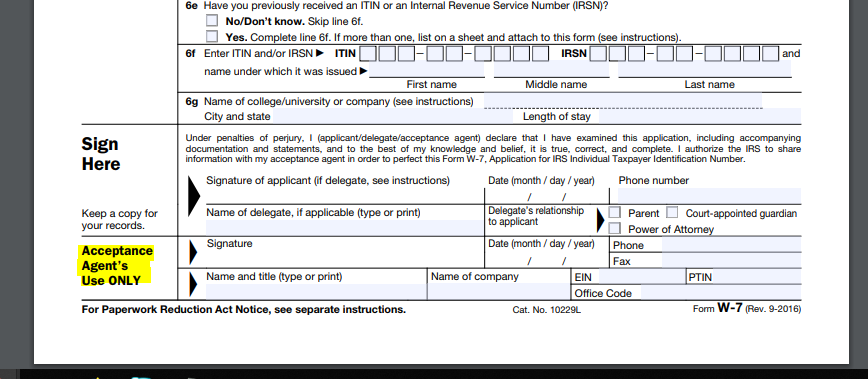

I have filled out many of these application with an almost perfect acceptance ratio. I’m also an IRS Certified Acceptance Agent (CAA) which allows me to authenticate most forms of IDs and be able to attach certified copies along with a Certificate of Accuracy (COA) so your original documents can stay with you. The additional fee for this service can give you tremendous peace of mind knowing that your valuable original documents are not at risk.

Thinks to Look For When Hiring Someone to Assist You With This Form.

As shown in the highlighted section in the image above, if you hire an authorized agent to fill out this form, make sure that the “Acceptance Agent’s Use ONLY” section is properly and fully filled out showing the agent’s information.